The era of the generalist manufacturer is over; global dominance now belongs to specialists who build a complete and defensible strategic ecosystem around their niche.

- Specialization is not just a product choice; it’s a total business system that creates a “defensible moat” large competitors cannot easily cross.

- Your go-to-market channels, integration model, and R&D investments must be radically realigned to serve and protect this niche, not a broad, diluted market.

Recommendation: Stop debating diversification versus specialization and start architecting your unique specialization ecosystem. This is the only path to sustainable leadership.

In boardrooms across the manufacturing sector, a familiar debate rages on. Faced with margin compression and fierce global competition, executives are pressured to find new avenues for growth. The conventional wisdom often points toward diversification—expanding product lines, entering adjacent markets, and becoming a one-stop-shop for customers. This strategy, predicated on capturing a larger share of the wallet, feels safe and logical. It promises growth by casting a wider net.

However, this pursuit of breadth often comes at a steep, hidden cost: the dilution of core identity and the erosion of true competitive advantage. While generalists are busy trying to be everything to everyone, a new breed of focused, agile specialists is quietly conquering the most profitable segments of the global market. They understand a fundamental truth that many have forgotten in the chase for scale.

What if the key to not just surviving, but achieving unassailable market dominance, isn’t about doing more, but about doing one thing better than anyone else on the planet? This article argues that true global leadership is no longer attainable for the generalist. Instead, it is the direct result of building a defensible strategic ecosystem around a well-defined industrial specialization. This is not merely about choosing a niche; it’s about architecting your entire organization—from R&D to your sales channels—to create an impenetrable competitive moat.

We will deconstruct this modern reality, moving from the systemic failure of the generalist model to a clear blueprint for identifying, building, and defending a winning specialization strategy. This is the new playbook for manufacturing leadership.

This guide provides a strategic framework for manufacturing executives, detailing the shift from generalist vulnerability to specialist dominance. Explore the sections below to understand how to build and defend your niche for global leadership.

Summary: The Manufacturer’s Playbook for Niche Market Leadership

- Why the Generalist Manufacturer Is Losing Market Share Globally?

- How to Identify a Profitable Industrial Niche in Foreign Markets?

- The Danger of Diluting Your Core Competency in Pursuit of Growth

- Vertical vs. Horizontal Integration: Which Supports Specialization?

- Investing in R&D: Problem & Solution for Maintaining Niche Leadership

- Innovation as Entry Ticket: Problem & Solution for Commodity Sellers

- Distributor Network vs. Direct Sales: Which Penetrates Faster?

- Marketplace vs. Owned Channel: Which Yields Better ROI for Manufacturers?

Why the Generalist Manufacturer Is Losing Market Share Globally?

The strategic landscape has fundamentally shifted. The “jack-of-all-trades” manufacturer, once a symbol of industrial might, is now finding itself outmaneuvered and undercut at every turn. The core reason is a tectonic role realignment across industries, where deep expertise consistently triumphs over broad, shallow capabilities. This isn’t a temporary downturn; it’s a structural change. As one industry analysis bluntly puts it, “We’re not in a tech hiring slowdown. We’re in a tech role realignment, where yesterday’s generalists are being replaced by tomorrow’s specialists.” This trend, born in tech, is now redefining manufacturing.

While generalist manufacturers are stretched thin managing diverse supply chains, varied customer needs, and multiple production processes, focused competitors are dedicating 100% of their resources to dominate a single area. They innovate faster, understand customer pain points more deeply, and optimize their cost structures with ruthless efficiency. The market is rewarding this focus. A recent industry analysis reveals that while over 95,000 general tech workers were laid off, AI specialists were commanding salaries upwards of $300,600, signaling an irreversible premium on specialization.

The cautionary tale of Intel serves as a stark warning. The company, once the undisputed king of CPUs, saw its dominance erode as it struggled to compete with specialized chip designers like NVIDIA in the AI space and TSMC in advanced manufacturing. The attempt to be both a leading designer and a world-class foundry led to a dilution of focus. This is evidenced by a sharp decline where, between 2021 and 2024, Intel’s revenue dropped by over 30%, highlighting a continuous loss of market share to more specialized rivals. The generalist’s kingdom is shrinking because its walls are too wide to defend effectively.

How to Identify a Profitable Industrial Niche in Foreign Markets?

Identifying a defensible niche is not a search for an empty field; it is a strategic hunt for a weak link in an established value chain where your company can provide an unparalleled solution. It requires a mindset shift from “What can we sell?” to “What critical, underserved problem can we solve better than anyone else?” A profitable niche often exists at the intersection of a complex customer need, a high barrier to entry for generalists, and your own unique engineering or process capabilities.

The analysis should begin internally, with a ruthless assessment of your “core-of-the-core” competency. What is the one process, technology, or skill set where your team is truly world-class? Now, look externally. Where in the global market is this specific competency most undervalued or poorly served? The goal is to find a segment small enough to be overlooked by industrial giants, but large enough to be highly profitable when scaled across multiple countries. As according to Wharton research, selling to a small, specific market segment across a large number of national markets can be an enormously profitable strategy.

This process involves looking for signals of friction: complaints about component failure, frustrations with lead times, or the use of over-engineered, expensive solutions where a more specialized, cost-effective alternative would suffice. These are the entry points. By focusing on a micro-niche, a manufacturer can develop a reputation as the definitive expert, creating a powerful “niche gravity” that pulls in the most valuable customers globally.

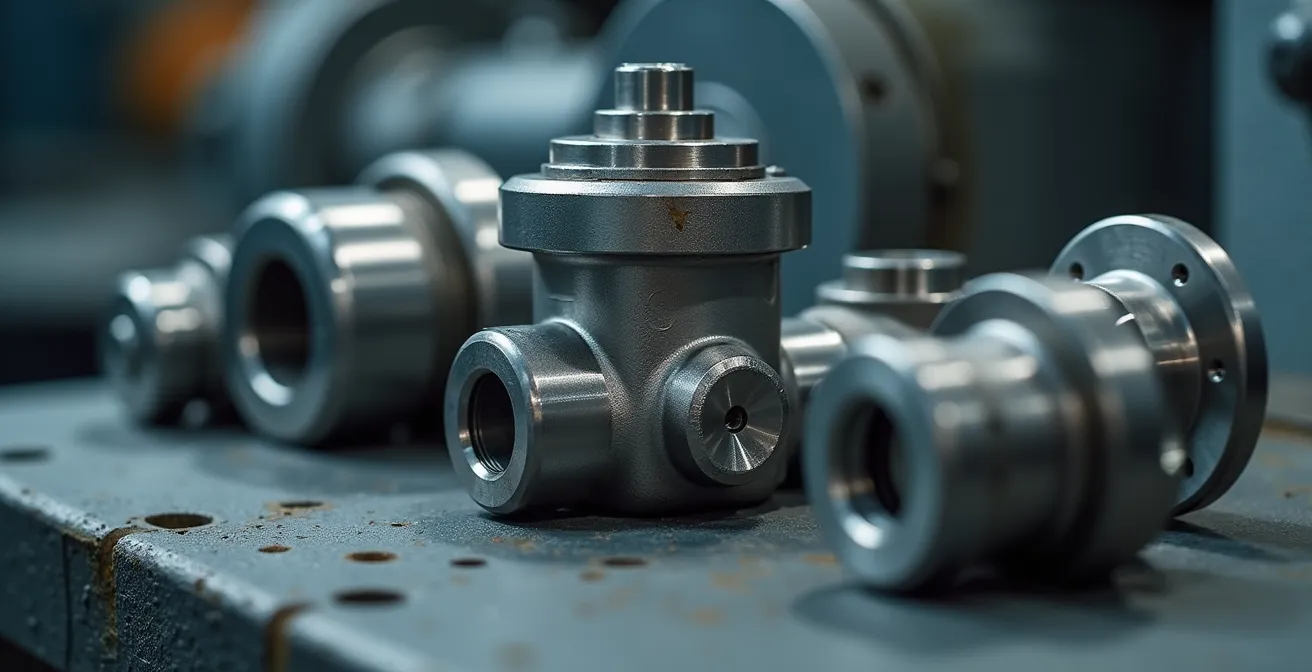

The visual above illustrates this concept: within a complex assembly, a single specialized component can be the key to unlocking superior performance and creating a profitable niche. It is by mastering such a specific element that a manufacturer builds its strategic moat.

Action Plan for Identifying a Profitable Industrial Niche

- Core Competency Audit: List the top three technical processes or skills where your company has a demonstrable and defensible advantage over competitors.

- Value Chain Friction Analysis: Interview customers and industry experts to identify points of recurring failure, inefficiency, or high cost in their current supply chains.

- Market “Invisibility” Check: Research potential niches to assess whether they are too small to attract the attention of large, global generalists. Cross-reference this with market size data across multiple countries.

- Profitability & Scalability Modeling: For the top two identified niches, create a financial model projecting profitability based on selling a specialized product across at least five target foreign markets.

- Competitor-Response Simulation: For your primary niche target, outline the likely competitive response from incumbents and define your counter-strategy to defend your position.

The Danger of Diluting Your Core Competency in Pursuit of Growth

Once a defensible niche is established, the greatest threat often comes not from competitors, but from within: the temptation to “grow” by diversifying. This siren song of adjacent markets and new product lines is the leading cause of strategic drift. Every dollar and engineering hour spent on a non-core initiative is a resource stolen from the defense and reinforcement of your primary competitive advantage. This dilution is a slow-acting poison that makes the company vulnerable.

As one analysis notes, “Specialization allows businesses to focus their efforts on a specific segment of the market, catering to a unique set of needs and preferences that are often overlooked by larger competitors.” This focus is an asset that must be protected at all costs. When a specialized manufacturer starts chasing growth in unrelated areas, it begins to think and operate like the very generalists it once defeated. Its messaging becomes muddled, its R&D priorities get confused, and its operational excellence in the core niche inevitably degrades.

The contrast between a focused specialist and a diluted generalist is stark. Consider the following example.

Case Study: Protolabs’ Success Through Unwavering Focus

Protolabs, a digital manufacturing company, built its entire business model around a highly specific niche: on-demand rapid prototyping and low-volume custom parts. Instead of trying to compete with massive contract manufacturers on high-volume production, they focused exclusively on customers who needed speed, customization, and precision in 3D printing, CNC machining, and injection molding. This unwavering focus allowed them to build a proprietary software platform and a highly efficient production system that generalists cannot replicate. By resisting the temptation to enter high-volume manufacturing, Protolabs has built a defensible, high-margin market position as the go-to provider for engineers and designers under tight deadlines.

Protolabs’ success demonstrates the power of strategic discipline. They understood that their real asset was not just their machines, but their mastery of a specific process and customer need. Any deviation would weaken that mastery and open the door to competition. Protecting the core competency is not about limiting growth; it is about ensuring that growth is sustainable and profitable.

Vertical vs. Horizontal Integration: Which Supports Specialization?

Once a niche is chosen, the next critical decision is structural: how should the company organize to best protect and exploit this specialization? The classic strategies of vertical and horizontal integration must be viewed through this new lens. The right choice is not universal; it depends entirely on the nature of the specialization itself. The goal is no longer just scale or cost control, but the reinforcement of the competitive moat around your niche.

This strategic choice also reflects a broader shift in the manufacturing workforce. The need is no longer for legions of production workers, but for highly skilled specialists in engineering, data science, and process optimization. Deloitte analysis shows production occupations now make up just 48.7% of the manufacturing workforce in 2024, down from 51.9% in 2003, highlighting a move toward a more knowledge-based, specialized labor force.

An integration strategy must support this new reality. For a company whose advantage lies in a proprietary manufacturing process, deep vertical integration—controlling every step from raw materials to final assembly—may be the only way to protect its intellectual property. Conversely, for a firm whose edge is in deep market knowledge and customer relationships within a specific application, horizontal integration—acquiring other small specialists in related micro-niches—can consolidate its position as the undisputed category king. A third path, virtual vertical integration, offers a capital-efficient way to exert control through exclusive contracts and JVs without the burden of ownership. The key is aligning the structure with the strategy.

The following table breaks down these strategic choices, helping to align your integration path with your specific specialization goal.

| Integration Type | Best For | Key Benefit | Example |

|---|---|---|---|

| Deep Vertical | Process advantage | Control entire value chain | Controlling raw materials to software |

| Horizontal | Market knowledge | Dominate micro-niches | Acquiring related specialized firms |

| Virtual Vertical | Capital efficiency | Control without ownership | Exclusive contracts and joint ventures |

Investing in R&D: Problem & Solution for Maintaining Niche Leadership

For a specialized manufacturer, R&D is not a cost center; it is the engine of its survival and the primary tool for deepening its competitive moat. While generalists must spread their R&D budget across a wide portfolio of unrelated products, the specialist has the immense advantage of focus. It can concentrate its entire innovation firepower on solving the next generation of problems within its chosen niche, creating a virtuous cycle or “innovation flywheel” that imitators cannot catch.

The problem, however, is one of allocation. How do you balance the need to support and improve today’s core products with the need to invent tomorrow’s breakthroughs? A proven framework for this is the 70-20-10 model. A Google’s innovation framework allocates its resources strategically: 70% on core product improvements (defending the current business), 20% on adjacent innovations (expanding the niche’s boundaries), and 10% on “moonshot” or transformational projects (inventing the future of the niche).

This balanced approach, visualized above, ensures that the company simultaneously protects its current revenue streams while placing calculated bets on future growth, all within the strategic context of its specialization. It prevents the organization from becoming complacent while also avoiding the pitfall of chasing speculative projects that dilute its core focus. As ITONICS notes, “Companies with strong talent development systems and large R&D budgets can afford to explore radical and big picture innovations. Others focus on supporting existing products or improving internal processes to boost performance.” For the specialist, the 70-20-10 rule provides a scalable model to do both.

Innovation as Entry Ticket: Problem & Solution for Commodity Sellers

For manufacturers in highly commoditized markets—steel, basic chemicals, standard fasteners—the path to specialization can seem impossible. When your product is sold primarily on price and specification, how can you build a defensible niche? The answer lies in shifting the focus of innovation from the product itself to the process, the business model, or the customer experience surrounding it. This is how commodity sellers purchase their ticket out of the price-war arena.

The problem for commodity producers is that they are trapped in a “red ocean” of competition where any product feature is quickly copied. The solution is to create a “blue ocean” by innovating in an area competitors have ignored. This could mean developing a proprietary logistics system that guarantees faster and more reliable delivery, creating a software platform that helps customers manage their inventory more efficiently, or pioneering a new, more sustainable production process that appeals to environmentally conscious buyers.

This is not about making a slightly better commodity; it is about wrapping the commodity in a layer of unique, high-value service or technology that becomes the new basis for competition. This is the essence of building a strategic ecosystem around a core offering.

Case Study: 3M’s Culture of Innovation Beyond the Commodity

Manufacturing giant 3M, a producer of countless materials that could be considered commodities, pioneered a culture of “15% time” decades ago. This policy allowed its researchers to dedicate a significant portion of their workweek to exploratory projects with no immediate or obvious business application. This freedom to innovate beyond simple product improvements has yielded globally dominant products like Post-it Notes and Scotchgard. 3M demonstrates a powerful principle: even a commodity manufacturer can achieve profound specialization and market leadership by fostering a culture that encourages innovation in adjacent and transformational areas, turning basic materials into unique, patent-protected solutions.

The 3M example proves that innovation is the most powerful lever for escaping commoditization. By creating a culture that values and rewards creative problem-solving, even the most traditional manufacturer can redefine its market and build a powerful, specialized brand.

Distributor Network vs. Direct Sales: Which Penetrates Faster?

The choice between a distributor network and a direct sales force is a pivotal decision in a specialist’s go-to-market strategy. There is no single right answer; the optimal choice is dictated by the nature of the niche and the strategic objective. The question is not simply “Which is faster?” but rather “Faster to what end?” The two models offer speed in fundamentally different dimensions: one offers speed of *access*, the other speed of *adoption*.

A distributor network provides unparalleled speed of market access. By leveraging the existing infrastructure, relationships, and logistical capabilities of established partners in foreign markets, a manufacturer can achieve broad product availability almost overnight. This strategy is ideal for specialized products that are relatively easy to understand, have a wide potential customer base within the niche, and do not require extensive technical consultation before purchase. For a specialist looking to rapidly scale its presence and capture market share from slower incumbents, distributors are an unmatched force multiplier.

Conversely, a direct sales force offers superior speed of market adoption for complex, high-value specializations. When a product requires deep technical expertise, a consultative sales process, and significant customer education, a direct team is essential. These internal experts act as ambassadors for the brand, capable of demonstrating value, overcoming technical objections, and building deep, long-term relationships. This approach is slower in achieving broad geographic coverage, but it is far more effective at penetrating key accounts, securing high-margin deals, and gathering invaluable customer feedback that fuels the innovation flywheel.

The decision must align with the strategic ecosystem. A niche built on process efficiency and broad applicability (e.g., a unique fastener) thrives with distributors. A niche built on solving a highly technical engineering challenge (e.g., a custom automation system) demands a direct sales force. Choosing the wrong channel is like fitting a race car with off-road tires—the core machine is powerful, but its performance is crippled by a mismatched connection to the road.

Key Takeaways

- The generalist model is failing due to a market-wide shift that rewards deep, specialized expertise over broad capabilities.

- A profitable niche is found not by avoiding competition, but by identifying and solving a critical, underserved problem within a larger value chain.

- The entire organization—from its corporate structure to its R&D budget and sales channels—must be architected as a cohesive ecosystem to defend and deepen the specialization.

Marketplace vs. Owned Channel: Which Yields Better ROI for Manufacturers?

In the digital age, the “where” of selling is as critical as the “what.” For a specialized manufacturer, the choice between leveraging third-party marketplaces (like Amazon Business or industry-specific platforms) and building an owned direct-to-customer (D2C) channel is a decision with profound long-term implications for ROI. Viewing this choice merely through the lens of immediate sales and transaction costs is a strategic error. The true ROI must be measured in terms of data, customer relationships, and brand control—the core pillars of a defensible ecosystem.

Marketplaces offer immediate access to a vast audience. They are powerful top-of-funnel tools for discovery, allowing a specialist to test demand in new markets with minimal upfront investment. However, this access comes at a cost: margin erosion through fees, intense price competition, and, most importantly, a complete separation from the end customer. The marketplace owns the relationship and the data, leaving the manufacturer as a faceless supplier.

An owned channel, by contrast, is a long-term investment in building a strategic asset. While it may generate fewer sales initially, its true value is incalculable. As one insightful Industry Analysis puts it, “An owned channel’s primary ROI is not the immediate sale, but the collection of first-party customer data. For a niche manufacturer, this data on usage patterns, re-order rates, and service requests is the most valuable asset for future product development and marketing.” This direct feedback loop is the lifeblood of the innovation flywheel, allowing the specialist to anticipate market needs and further deepen its moat.

The most sophisticated strategy is a two-stage approach. Use marketplaces as a targeted tool for new market entry and customer acquisition. However, every touchpoint—from product packaging to post-sale support—should be designed to migrate that customer to the owned channel for future interactions, re-ordering, and community building. This transforms the marketplace from a competitor to a lead-generation engine for your most valuable asset: your direct customer relationships.

To win in the next decade, the question is no longer if you should specialize, but how you will architect the complete business system to defend that specialization. The process begins today, with a rigorous and honest audit of your core competencies and a visionary plan to build your unassailable market niche.