Scaling for export often triggers a critical failure: quality fade. The solution isn’t working harder, but engineering a more resilient production ecosystem where quality is a non-negotiable design parameter.

- Identify and systematically eliminate bottlenecks using Lean principles, rather than just adding capacity.

- Shift from manual, retroactive Quality Control (QC) to automated, predictive quality assurance systems.

- Diversify your supply chain and rigorously vet partners for scalability and resilience, not just unit cost.

Recommendation: Treat every process—from sourcing to shipping—as a variable that must be systematically controlled to make quality an inevitable outcome of your scaled-up operation.

The export order arrives—20% larger than any previous run. For a factory manager or production lead, this is a moment of triumph, quickly followed by a cold sense of dread. How do we meet this sudden spike in demand without the entire system buckling, production grinding to a halt, and, most critically, without product quality plummeting? It is the ultimate test of a manufacturing operation’s robustness.

The knee-jerk reaction is often to demand more: run lines faster, add emergency shifts, and pressure suppliers for quicker turnarounds. We are often told the generic solutions are to “automate” or “improve communication.” While not incorrect, these are surface-level fixes that fail to address the underlying structural weaknesses that a significant increase in volume ruthlessly exposes. These reactive measures are the pathway to defects, delays, and damaged client relationships.

What if the challenge is not about producing more, but producing smarter? The real key to scaling without sacrificing quality lies in building a resilient production ecosystem. This is a strategic shift from viewing production as a linear sequence to seeing it as an interconnected system. In this model, quality is an engineered outcome of every process, not a feature you frantically inspect for at the end of the line. It requires a level of systematic control that transforms pressure into predictable, high-quality output.

This guide provides a systematic framework for factory managers and production leads to navigate this challenge. We will deconstruct the process of scaling, moving from diagnosing hidden bottlenecks and applying targeted Lean principles to making the critical decisions about automation, sourcing, and even sustainable logistics that define a truly scalable and high-quality manufacturing operation.

Summary: Scaling Manufacturing for Export Without Compromising Quality

- Why Bottlenecks Occur When Export Volume Increases by 20%?

- How to Apply Lean Principles to Export-Bound Production Lines?

- The Risk of Single-Source Suppliers When Scaling Output

- Manual QC vs. Automated Vision Systems: The Solution for Zero Defects

- In-House Production vs. Contract Manufacturing: Which Scales Faster?

- Achieving Carbon Neutrality: A Sequence of Steps for Logistics

- Why “Quality Fade” Happens After the First Few Shipments?

- How to Vet Suppliers in a Fragmented Global Marketplace?

Why Bottlenecks Occur When Export Volume Increases by 20%?

A 20% increase in production volume doesn’t create 20% more stress on your system; it creates exponential pressure that targets the weakest link. This is the fundamental nature of a bottleneck. It is the single process or resource that limits the throughput of the entire operation. Under normal conditions, it may go unnoticed, but a sudden demand spike forces more work through it than it can handle, causing upstream inventory to pile up and downstream processes to starve. This constraint dictates the true maximum capacity of your entire production line, regardless of how efficient other areas are.

These constraints are not always machine-based. Often, they are hidden within human systems, tooling, or information flow. A sudden demand spike can expose weaknesses in labor capacity or skill sets, a problem magnified when export-specific tasks like specialized packaging or documentation are required. In fact, a recent analysis revealed that more than 20.6% of US manufacturing plants couldn’t operate at full capacity due to labor shortages alone. Other common hidden bottlenecks include quality control inspection points, tooling availability for changeovers, or the approval process for shipping documents.

Identifying the primary bottleneck is the first, most critical step in scaling. Simply increasing the speed of non-bottleneck processes will only create more work-in-progress inventory and chaos. The industrial engineer’s approach is to apply the Theory of Constraints (TOC): identify the constraint, exploit it (ensure it’s running at 100% efficiency), subordinate everything else to its pace, and only then elevate its capacity through investment. This systematic approach prevents wasteful spending and ensures that any improvement directly impacts overall output.

How to Apply Lean Principles to Export-Bound Production Lines?

Lean manufacturing is not merely about “cutting waste”; it is a systematic philosophy for maximizing customer value while minimizing resource usage. When scaling for export, its principles become essential tools for increasing throughput without increasing defects. The goal is to create a production flow that is smooth, predictable, and resilient. For export-bound lines, this means applying Lean thinking not just to the physical product, but to the entire value stream, including documentation, compliance, and logistics.

The starting point is Value Stream Mapping (VSM). This is a visual representation of every single step involved in getting your product from raw material to the export customer. It forces you to differentiate between value-added activities (what the customer pays for) and non-value-added waste (delays, rework, unnecessary movement). For an export line, the VSM must include critical steps like customs paperwork generation, compliance checks, and container loading, as these are frequent sources of delay.

Once the value stream is mapped, you can apply specific Lean tools. 5S (Sort, Set in Order, Shine, Standardize, Sustain) creates an organized and efficient workspace, reducing time spent searching for tools or information. Poka-Yoke (error-proofing) is particularly powerful for export processes; this could be a software checklist that prevents a shipment from being booked until all customs documents are uploaded, or a fixture that ensures products are packed in the correct orientation for international transit. The DMAIC (Define, Measure, Analyze, Improve, Control) framework provides a structured project-based approach to solving specific problems identified in the VSM.

The Risk of Single-Source Suppliers When Scaling Output

Relying on a single supplier for a critical component is one of the most significant strategic risks in manufacturing, and this danger is amplified exponentially during a rapid scale-up. When you increase your order volume by 20%, you are not just testing your own production line; you are stress-testing your supplier’s entire operation. If they cannot scale at the same pace, their failure becomes your failure. A single point of failure in the supply chain can halt your entire production, leading to missed deadlines, penalty clauses, and catastrophic damage to your reputation with a new export client.

The risk is compounded by global interdependencies. With a significant portion of component materials often imported, manufacturers are exposed to a complex web of potential failure points including geopolitical instability, shipping delays, and raw material shortages. A single-source strategy leaves no buffer against these disruptions. This dependency creates a fragile system, the exact opposite of the resilient production ecosystem required for sustainable growth. Diversifying your supply base is not a cost; it is an insurance policy against catastrophic failure.

Effective risk mitigation requires moving beyond a simple cost-down approach to sourcing and embracing a more strategic view of supplier relationships. This involves proactively building redundancy and visibility into your supply chain. The following table outlines key strategies to mitigate the inherent risks of dependency:

| Strategy | Implementation | Risk Reduction |

|---|---|---|

| Geographic Diversification | Qualify secondary suppliers in different regions | Mitigates regional disruptions (e.g., natural disasters, trade policy changes) |

| Contractual Safeguards | Include IP escrow, technology transfer clauses, and firm capacity commitments | Protects against supplier failure, bankruptcy, or IP theft |

| Second-Tier Visibility | Audit your critical supplier’s own dependencies on their suppliers | Identifies and prepares for hidden vulnerabilities one level deeper in the chain |

Building this resilience requires an upfront investment in qualifying and managing multiple suppliers, but the long-term benefit of an agile and robust supply chain far outweighs the initial cost. It is a foundational element of designing an operation that can not only handle a demand spike but thrive on it.

Manual QC vs. Automated Vision Systems: The Solution for Zero Defects

As production volume increases, manual quality control (QC) becomes a primary bottleneck and a major source of inconsistency. Human inspectors are prone to fatigue, subjective judgment, and error, especially when pressure mounts to increase throughput. Manual QC is a reactive measure that scales poorly; you cannot simply hire 20% more inspectors and expect a 20% improvement in quality. In fact, the added complexity and communication overhead often lead to diminishing returns. The solution is to transition from a reactive, manual inspection process to a proactive, automated quality assurance system.

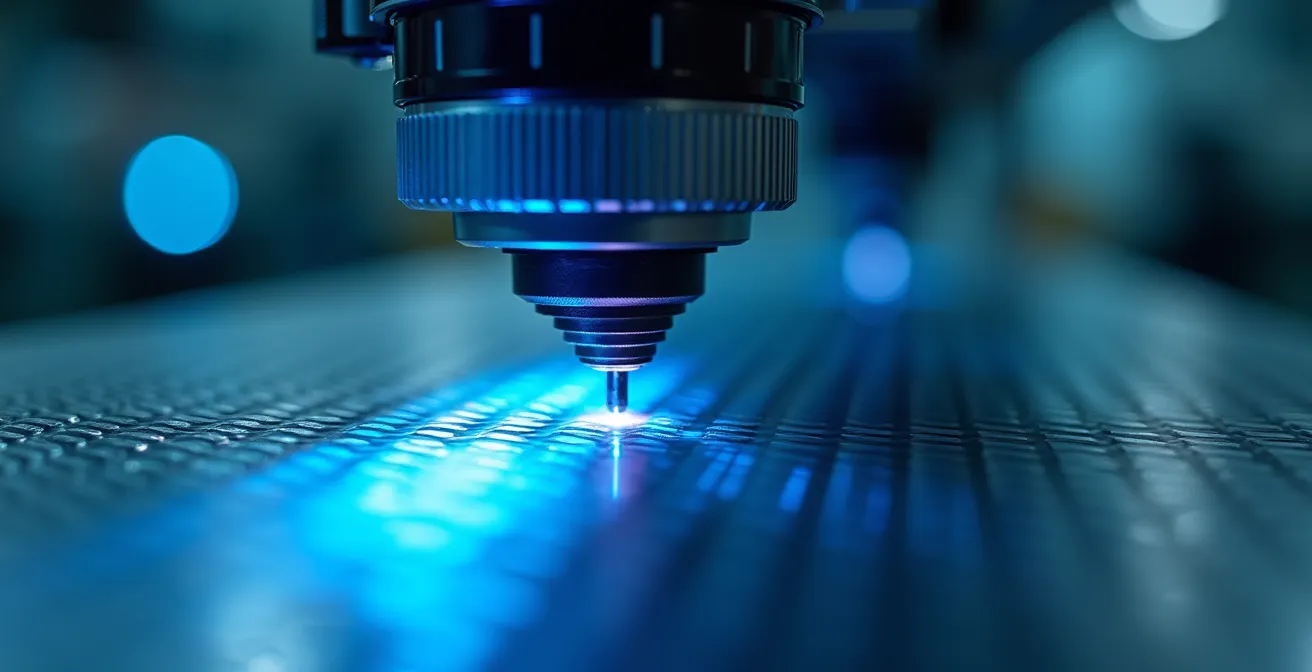

Automated vision systems are a cornerstone of this transition. Using high-resolution cameras, advanced lighting, and AI-powered software, these systems can inspect 100% of products on the line for defects related to dimensions, surface finish, color, and assembly completeness at speeds far exceeding human capability. They provide objective, repeatable data that can be used not just to catch defects, but to prevent them. By flagging process deviations in real-time, they enable Statistical Process Control (SPC), allowing operators to make adjustments before out-of-spec products are even produced.

Case Study: Semiconductor Quality Improvement

A semiconductor manufacturer, facing unacceptable scrap rates, implemented Statistical Process Control on its critical wafer etching processes. By using automated sensors to monitor key variables in real-time and applying control charts, they were able to identify and correct process drifts before they resulted in defects. This shift from post-production inspection to in-process control led to a 72% reduction in defect rates, saving millions in scrap and rework costs and dramatically increasing shippable yield.

The concept extends beyond simple vision systems. The use of digital twins—virtual replicas of a physical production line—is revolutionizing quality assurance. By simulating the impact of process changes in a virtual environment, engineers can optimize for quality before touching the physical line. As a testament to their power, McKinsey research shows that digital twins can reduce downtime by up to 50% and increase productivity by 20-30%. This represents the ultimate form of proactive quality management: engineering defects out of the system entirely.

In-House Production vs. Contract Manufacturing: Which Scales Faster?

When an export order demands a rapid increase in volume, a critical strategic question arises: do we scale our own production (in-house), or do we outsource to a contract manufacturing organization (CMO)? This is not a simple question of cost, but a complex trade-off between speed, control, and long-term strategic flexibility. The right choice depends entirely on your business objectives, risk tolerance, and the maturity of your internal processes.

Contract manufacturing offers the undeniable advantage of speed and reduced capital expenditure (CAPEX). A qualified CMO already has the facility, equipment, and trained workforce in place. They can theoretically absorb your increased demand almost immediately, allowing you to meet the export order without the massive upfront investment and lead time associated with building a new line or factory. This makes it an attractive option for businesses looking to test a new market or handle a temporary demand spike without taking on long-term risk.

However, this speed comes at the cost of control. When you outsource, you are handing over a critical part of your value chain. This introduces significant risks related to quality consistency (“quality fade”), intellectual property (IP) protection, and supply chain visibility. You become dependent on the CMO’s own systems, culture, and priorities, which may not align with your own. Scaling in-house, while slower and more capital-intensive, provides absolute control over your production ecosystem. It allows you to directly implement your own Lean principles, quality systems, and process innovations, ensuring that the product delivered to the end customer perfectly reflects your brand’s standards.

The decision must be a strategic one, based on a clear understanding of the total cost and benefit. As manufacturing consultancy GENEDGE points out, sustainable growth is about smart system-building, not just adding overhead.

Companies that out-scale competitors follow clear manufacturing business strategies: they pick the right technology, tighten daily processes, and train people to run bigger systems. The payoff is growth in revenue, not in overhead.

– GENEDGE Manufacturing Consultancy, How to Scale Manufacturing Business & Maximize Profits

Achieving Carbon Neutrality: A Sequence of Steps for Logistics

In today’s global marketplace, building a resilient production ecosystem is no longer just about quality and speed; it’s increasingly about sustainability. Achieving carbon neutrality in your logistics and supply chain is not a peripheral “green” initiative but a core component of modern operational excellence. Export customers, particularly in Europe, are placing greater emphasis on the environmental footprint of their partners. A demonstrable commitment to sustainability can be a powerful competitive differentiator and a key factor in winning long-term contracts.

The path to carbon-neutral logistics is a sequence of strategic steps, not a single action. It begins with measurement: conducting a thorough audit of your entire supply chain’s carbon footprint (Scope 1, 2, and 3 emissions). This provides the baseline data needed to identify the biggest sources of emissions, which are often found in transportation, warehousing, and packaging. Once you have this data, you can begin to optimize.

Optimization strategies include route planning software to minimize fuel consumption, transitioning to electric or alternative-fuel vehicles for local transport, and consolidating shipments to maximize container utilization. Packaging is another critical area; switching to lighter, recyclable materials not only reduces waste but also lowers shipping weight and fuel costs. These efficiency gains often directly improve the bottom line, demonstrating that sustainability and profitability are not mutually exclusive. This alignment is part of a broader industry transformation, as a recent Deloitte study revealed that 83% of manufacturers believe smart factory solutions will transform production methods within five years, with sustainability being a key driver.

The final steps are reduction and offsetting. This involves investing in renewable energy for warehouses and, where emissions are unavoidable, purchasing high-quality carbon credits to offset the remaining impact. By integrating these steps into your operational strategy, you build a logistics network that is not only efficient and cost-effective but also resilient to future carbon-related regulations and aligned with the values of modern global customers.

Key Takeaways

- Scaling for export is an engineering problem requiring a systematic approach, not a brute-force one.

- Quality must be designed into every process (Lean, SPC, supplier vetting), not inspected for at the end of the line.

- Your supply chain’s resilience and scalability, not just its unit cost, will ultimately dictate your ability to grow successfully.

Why “Quality Fade” Happens After the First Few Shipments?

Quality fade is one of the most insidious threats when working with external suppliers, especially after scaling up production. It describes the gradual and often subtle degradation of product quality after the initial “golden” batches have been approved. The first shipments are perfect, meeting every specification. But over time, tolerances begin to drift, cheaper materials are substituted, or finishing processes are rushed. By the time the issue becomes apparent to the end customer, significant damage to your brand reputation may have already occurred.

This phenomenon is rarely born from malicious intent. It is most often the result of relentless cost pressure. Once a contract is secured, the supplier’s focus can shift from demonstrating capability to maximizing their own profit margin. This can lead to small, incremental changes that, individually, seem minor. A slightly different grade of plastic, a less rigorous polishing step, or a minute reduction in coating thickness can all contribute to a product that still “works” but lacks the durability and finish of the original. This is compounded by a lack of robust process control and standardized work on the supplier’s end.

Combating quality fade requires a proactive, systematic approach to supplier quality management. It is not enough to simply have a good initial specification. You must have systems in place to ensure that specification is adhered to consistently over time. This is where the principles of Lean and Six Sigma become crucial, not just for your own factory, but as a standard you require from your partners. The table below compares how these two powerful methodologies address the root causes of quality fade.

| Approach | Focus Area | Key Tools | Quality Fade Solution |

|---|---|---|---|

| Lean Manufacturing | Waste reduction and process flow | Kaizen, 5S, Visual Controls | Enforces rigorously standardized work instructions to ensure consistency. |

| Six Sigma | Variation reduction and defect elimination | SPC, DOE, FMEA | Uses statistical monitoring to detect and correct process drifts before they impact quality. |

| Lean Six Sigma | Combined approach | DMAIC, Value Stream Mapping | Builds a culture of continuous improvement focused on both efficiency and consistency. |

Ultimately, preventing quality fade means treating your supplier’s factory as an extension of your own, demanding the same level of process discipline and transparency that you enforce internally. It requires moving from a transactional relationship to a true partnership built on shared data and a mutual commitment to quality.

How to Vet Suppliers in a Fragmented Global Marketplace?

In a globalized economy, your production ecosystem is only as strong as its weakest link. Vetting suppliers, especially when preparing to scale for export, has become a complex, high-stakes process that goes far beyond a simple factory audit and price negotiation. You are not just buying a part; you are integrating a partner into your value chain. Your vetting process must therefore assess their capability, resilience, and alignment with your own standards for quality and scalability.

The traditional audit, focused on certifications like ISO 9001, is a starting point, not the destination. A truly robust vetting process must dig deeper into a potential supplier’s operational and financial health. It involves assessing their ability to handle a sudden demand surge without compromising on quality. Can their processes scale, or are they held together by heroic efforts that will collapse under pressure? Do they have a culture of continuous improvement, or are they focused solely on meeting the minimum specification at the lowest possible cost?

A modern supplier vetting framework must be a comprehensive audit that stress-tests a supplier’s capabilities across multiple domains. It should function as a due diligence process that gives you a clear picture of their true capacity for partnership. The focus must be on quantifiable evidence of stability and scalability.

Your 5-Point Supplier Scalability Audit

- Financial Stress Test: Request and analyze financial statements to simulate their ability to handle a 30% surge in raw material orders. Assess their cash flow and credit lines to ensure they can fund an increase in production without financial distress.

- Traceability & Systems Audit: Go beyond certifications. Demand a live demonstration of their end-to-end digital traceability. Can they trace a single finished good back to its specific raw material batch, machine, and operator in minutes?

- Operational Stability Analysis: Analyze their employee turnover rates and absenteeism data for the past 24 months. High turnover is a leading indicator of poor management, inconsistent training, and future operational problems.

- Production Planning & Control Assessment: Evaluate the robustness of their production planning systems (e.g., ERP, MRP). Do they use data-driven scheduling and capacity planning, or do they rely on manual spreadsheets and guesswork?

- Digital Integration Capability: Assess their ability and willingness to integrate their quality management and production systems with yours. A lack of API access or data-sharing protocols is a major red flag for a modern partnership.

By shifting the focus from vetting for cost to vetting for resilience and scalability, you lay the foundation for a supply chain that can support, rather than hinder, your international growth ambitions.

To put these principles into practice, the next logical step is to conduct a thorough audit of your current production line and supply chain’s true scalability. Begin by identifying your primary constraint and vetting your key suppliers not on price, but on their proven ability to grow with you.